How to Create a W-2 for your Nanny -- for free!

The new year 2019 is here. Hooray, and Happy New Year to everybody! If you employed a nanny in 2018, this also means that there is a high chance some nanny-related paperwork is awaiting you. In particular, it is time to create a W-2 form and give it to your nanny so that she can use it to prepare her tax documents.

Now, the beginning of January, is a good time to start with this because you typically want to give a draft of the W-2 to your nanny and ask her to look over everything. Once it is reviewed and everyone is happy with it, transmit the data to the Social Security Administration.

Our W-2 Process

Here is how my wife and I create and file the W-2, absolutely free:

- Check out the filing requirements. Here is some information about household employers’ requirements to file; and here is the 2018 household employer tax guide that explains when you have to withold social security taxes.

- Plan to get everything done by January 31st, 2019. The W-2s (and W-3) must be filed with the Social Security Administration by January 31st, 2019.

- Prepare to file. Check your records for your nanny’s address and social security number. You will also need to know how much you paid your nanny during the last year.

- Use the free Social Security Administration’s Business Services Online (BSO) service to create your W-2s. Follow this link to access the service.

- The BSO service will allow you to key in all the fields of a W-2 for every nanny you employed in the last year. If you need information about a specific field of the W-2, here is the official documentation. Here are the specific instructions about every box on the W-2 form.

- After you have created the W-2, share it with your nanny and ask her to cross-check her data on the W-2.

- If everything looks good, go back to the Business Services Online (BSO) site provided by the Social Security Administration and file the W-2/W-3 form.

The process above worked for my wife and me, but your situation might be different. Check with your accountant or tax consultant to be sure.

More Details

Filling out the individual boxes of the W-2 can be overwhelming, but if you have done it once: it should really be pretty easy for most household employers.

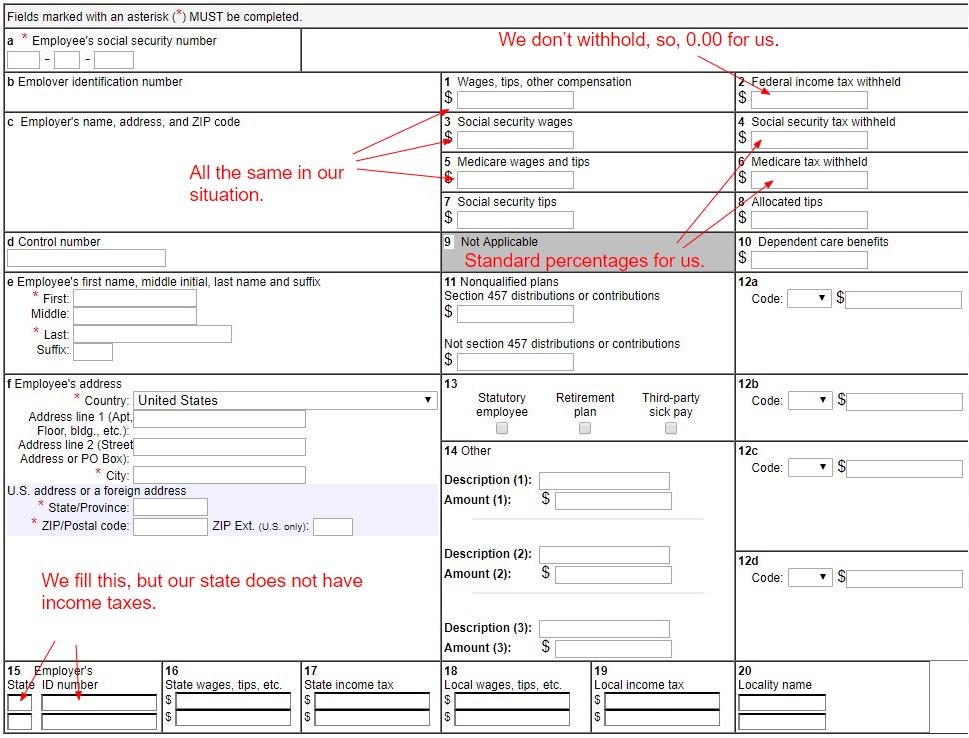

To be fair, we try to keep our books as simple as possible. For example, we don’t withhold income taxes for our nanny, and we don’t offer a healthcare plans or special forms of compensation. So, in our situation, filling out the form is pretty simple (again, your situation might be completely different):

- We have our nanny’s address from the I-9 form she completed on the first day of her work with us, but we also let her cross-check the W-2 before we file the information.

- The nanny’s social security number is also on the I-9 form she completed on the first day of her employment.

- The wages in boxes 1, 3 and 5 are all the same in our situation (again, yours can be different, but I would suspect that there are a lot of parents where this would be the same)

- We don’t withhold federal income taxes for our nanny, so box 2 is 0.00.

- Social security and medicare taxes are just the default share of the nanny for these taxes. We put this data on each paycheck.

- We don’t select anything in box 13. If you are interested in what a ‘Statutory Employee’ is, we found this thread helpful.

- We live in the State of Washington, where there is no state income tax. So, I just fill in the state, and our state ID number.

Here is how we fill out the form. Again, in your situation, this can be very different.

Conclusion

That’s it. This is how my wife and I create and file forms W-2/W-3 for our nanny. I hope this information is useful for you and saves you some time.

Always keep in mind that your situation can be entirely different than ours, so make sure to not blindly copy our process. Do all the research you need.

Overall, we found it is completely possible to create W-2/W-3 forms without a lot of overhead and completely free. Given how much we already have to spend on child care, this was good news for us!

Good luck!